Cross-border BRICS settlements

Instant low-fee Africoin settlements for merchants trading across South Africa, India and Brazil. Africoin removes SWIFT delays and FX bottlenecks for regional trade partners.

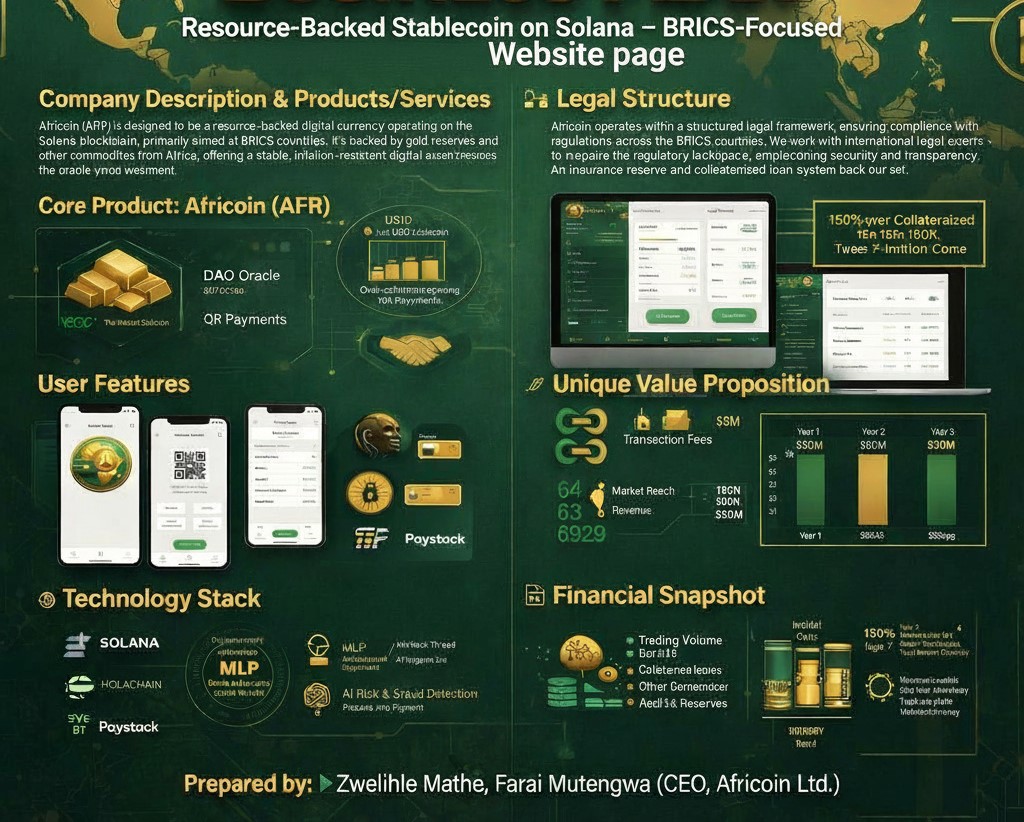

A resource-backed stablecoin on Solana, over-collateralized by tokenized gold and oil, designed as a soft USD alternative for high-speed, ultra-low-fee cross-border settlement.

A snapshot of core services and real-world deployments powered by Africoin across BRICS and global partners.

Instant low-fee Africoin settlements for merchants trading across South Africa, India and Brazil. Africoin removes SWIFT delays and FX bottlenecks for regional trade partners.

Retail stores accept Africoin via QR codes and virtual cards, reducing chargebacks and enabling instant settlements in local currency equivalents at point of sale.

Real-time AI monitors Africoin transactions for fraud, AML flags and abnormal flows, supporting institutional-grade compliance and risk controls.

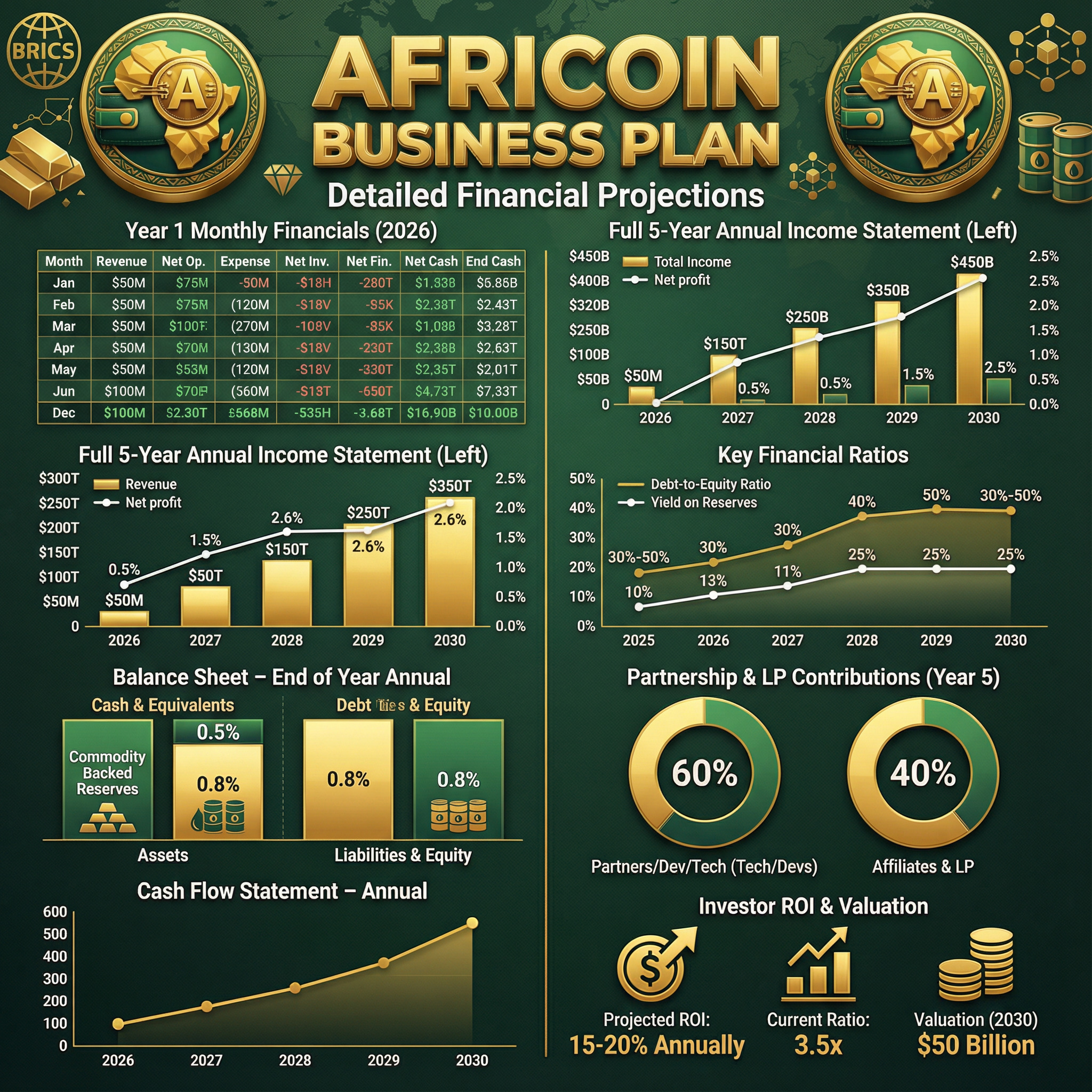

Tokenized gold and oil reserves provide transparent, on-chain collateral, giving investors and regulators confidence in Africoin’s long-term price stability.

Visual infographics and dashboards summarizing key metrics, collateral mix and BRICS adoption roadmap.